A pro forma invoice is essentially an estimated invoice issued by the seller/exporter in advance of a shipment. This is mostly given by the seller/exporter to the buyer to open the Letter of Credit (LC) or Telex Transfer (TT) from the buyer’s end. Pro forma invoice can be seen as a commitment from the seller to supply goods to the buyer.

Table of Contents

- Function of Pro Forma Invoice

- FOB: Free On Board

- CFR: Cost and Freight

- EXW: Ex Works

- Making the Pro Forma Invoice

- LC payment

- TT payment

- Difference between Pro forma Invoice and Commercial Invoice

Function of Pro Forma Invoice

Sometimes we hear the term “pro forma invoice” used interchangeably with “commercial invoice,” but these are not the same things and we need to know the difference between the two. It is important to know the difference between the two shipping documents, pro forma invoice and commercial invoice, as both have different functions in the international trade.

If we see, pro forma invoice contains the similar information as the commercial invoice does (description, origin, quantity, value, terms of delivery and payment) but it is not a final invoice, nor a request for payment. It can be seen as a commitment from the seller to supply goods and when accepted by the buyer by way of LC or TT, it becomes legally binding.

Pro forma invoice are documents used as preliminary invoices in support of a proposal or for financial purposes (enabling a buyer to apply for foreign exchange or to open a letter of credit or Telex Transfer).

We also use a pro forma invoice to accompany shipments of no commercial value, for example, gifts and samples for free distribution at trade shows. While making a pro forma invoice, an exporter uses many shipping terms like ex-work, fob, cfr.

Let us see the details of the terms here.

FOB: Free On Board

FOB (Free On Board) applies to goods transported by ships and boats through seas, rivers, and canals. The seller is responsible for transporting the goods to the departure port and pays for all associated costs and risks. The seller acquires the necessary export permits and other documentation to export from the origin port. The seller also does the customs clearance in the seller port. The seller’s responsibility ends after the goods have been loaded on to the vessel, as shipped onboard, if the contract is free on-board Shipping Point.

CFR: Cost and Freight

CFR (Cost and Freight) is wherein it is the seller’s sole responsibility to arrange for the transportation of the goods to pay for transporting the goods by waterways, either by sea, river, or canal, to a destination port specified by the buyer. In addition to paying for the transport of the goods, the seller has to pay for delivering the goods to the agreed upon departure port. The seller must also pay for acquiring export licenses and for loading the goods on to the transport vessel. The seller does everything from making the goods, customs clearance in the seller port and shipping payment. The seller’s liabilities end here as the CFR contract does not require the seller to insure the goods for further transportation. The buyer will have to insure the goods if they think it necessary.

EXW: Ex Works

Ex Works contract, the buyer transports the goods from the seller’s premises to the buyer’s destination. The transport mode may be whatever is convenient for both parties, road, rail, air, sea, or waterways. The buyer is responsible for loading the goods for transportation, acquiring export and import licenses, getting security clearances, paying taxes and customs duties, unloading the goods at the destination, storing the goods at a warehouse at the destination, and all other costs and liabilities. The buyer is also responsible for insuring the goods while they are in transit. The only responsibility the seller has is to make sure that the goods are properly packaged and available for transport, and that all the documentation for customs and shipping are in correct order. In this payment term method, the seller only makes the product and the rest is done by the buyer.

Making the Pro Forma Invoice

The pro forma invoice is made in supplier pad, directing the invoice to buyer with buyer’s name in To: Buyer.

The pro forma invoice number is also given and the date.

To note, before the supplier provides a pro forma invoice, the buyer provides the supplier with purchase order(PO), which is the details of the goods the buyer is willing to purchase for the seller. So, in the pro forma invoice the PO date number and date is provided.

This is very important to note that the date of the documents must be aligned with the chronological sequence of the documents. PO comes ahead of PI, so PO date will be earlier than PI.

The PI also contains from where the goods are shipped and the destination port and also the terms of the shipments.

Further, in the PI we can see, the description of the goods with the HS CODE of the goods, the amount of the goods the buyer is purchasing and the price.

We can also find the terms of payment are clearly mentioned. We can see 2 common payment methods that are used in international trade, which are LC and TT payments.

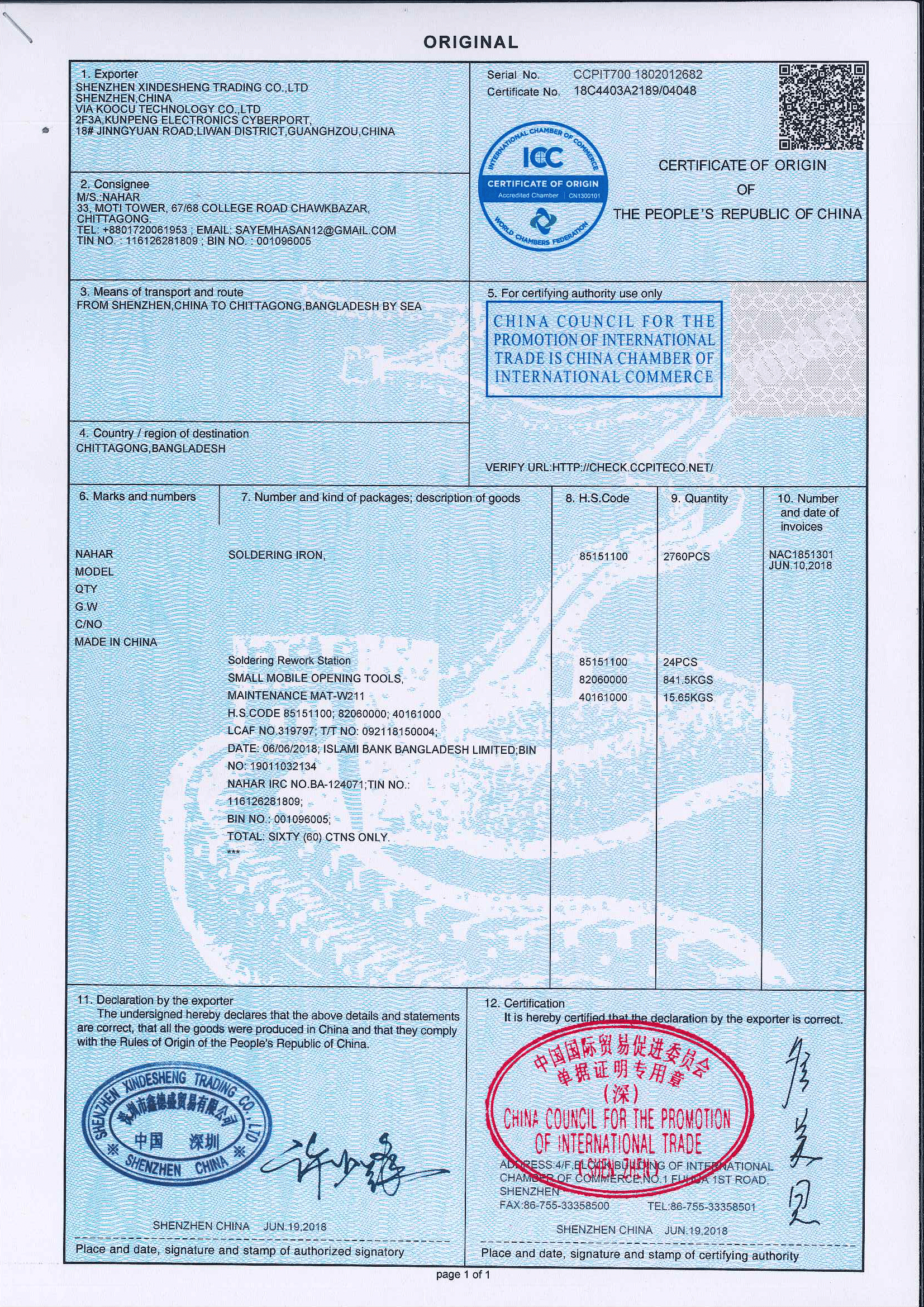

LC payment

A letter of credit, or “credit letter,” is a letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. So in here the bank is taking the responsibility of the payment against the buyer to the supplier. This is a bank to bank guarantee. The importer bank is giving the guarantee to the supplier bank, so the risk is minimal in this transaction.

TT payment

T/T payment stands for ‘Telegraphic Transfer.’ This is a payment method where the payment can be made in advance or in the middle of the production or at the end of the production to the supplier, as per the agreement between the buyer and the suppler. In other words, we can say TT payment is an international wire of funds from the buyer’s bank to the seller’s bank.

The terms of payment can take many forms like: 100% LC, 100% advance TT, 50% advance TT and 50% LC or any other terms as per discussion between the buyer and the seller.

The pro forma invoice also contains the details of the supplier including the address of the address of the supplier, Supplier/Beneficiary bank, bank address, bank swift code, account number and any other information that is necessary by the supplier to inform the buyer.

The pro forma invoice is sealed and signed by the supplier and send it to the buyer through mail by scanning the original PI.

Difference between Pro forma Invoice and Commercial Invoice

Finally, let us see the difference between pro forma invoice and commercial invoice in a chart.

| Pro forma Invoice | Commercial Invoice |

| A pro forma invoice is essentially an estimated invoice issued by the seller in advance of a shipment. | It is a contractual document between buyer and seller, whereby the seller supplies a certain quantity of a specific product at an agreed price with some conditions, i.e., terms of delivery (Incoterm®) and terms of payment. Commercial Invoice is the final quantity that is actually exported from seller end. |

| It contains the similar information as the commercial invoice does (description, origin, quantity, value, terms of delivery and payment) but it is not a final invoice, nor a request for payment. | It is the accounting document against which the buyer pays the seller |

| It can be seen as a commitment from the seller to supply goods and when accepted by the buyer by way of making LC or TT, it becomes legally binding. | It is also the main document used to support the customs declaration, since it provides the information on the commodity description (which determines the Harmonized System (HS) code), the origin (which determines the customs tariff treatment), the quantity and the value (which determines the value for customs, on which duties and taxes are calculated). |

After the buyer gets the sealed and signed pro forma invoice from the supplier, the buyer starts the processing to open the LC or TT to bind the contract to import from the supplier.